Economic Development Corporation

Donna Lowder

The Premier Community to

Live, Learn, Work, & Play!

Business Minded

Live Oak's commercial areas are premier locations for companies large or small who represent the next generation of innovation in their industries. Live Oak is known for its business-friendly operations.

Vibrant

Live Oak's amenities create a quality place that attracts companies; retains and recruits Wayland Baptist University and Northeast Lakeview College graduates for Live Oak’s workforce and entices visitors to eat, shop, stay, and play!

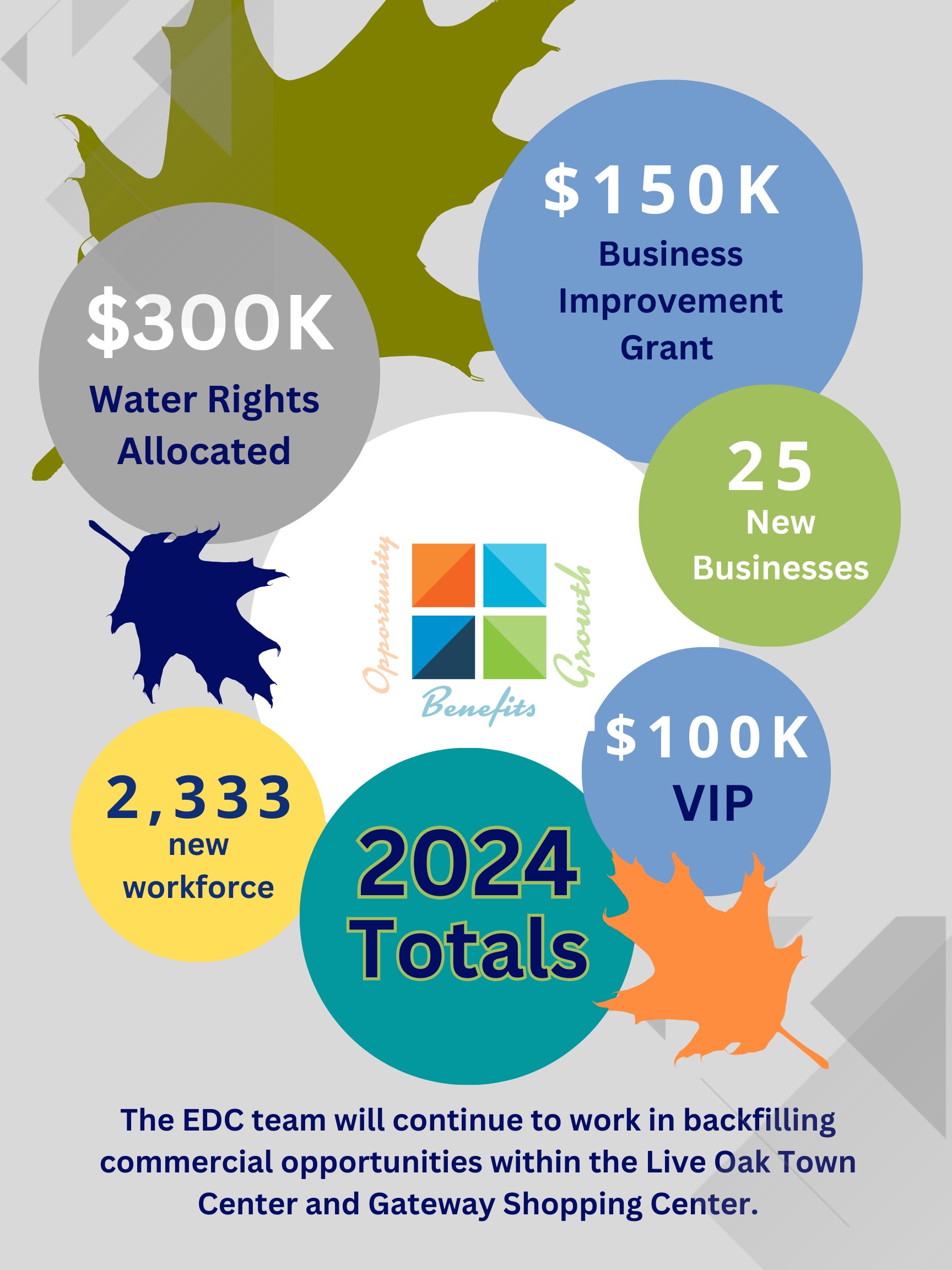

Growth

Live Oak will benefit from addressing the needs of residents and businesses within the City by delivering strategies that achieve equitable growth for all.

2024 EDC Annual Report

Click and drag to read the report or use the navigation dots below

Upcoming Events